Smart Business April 2014

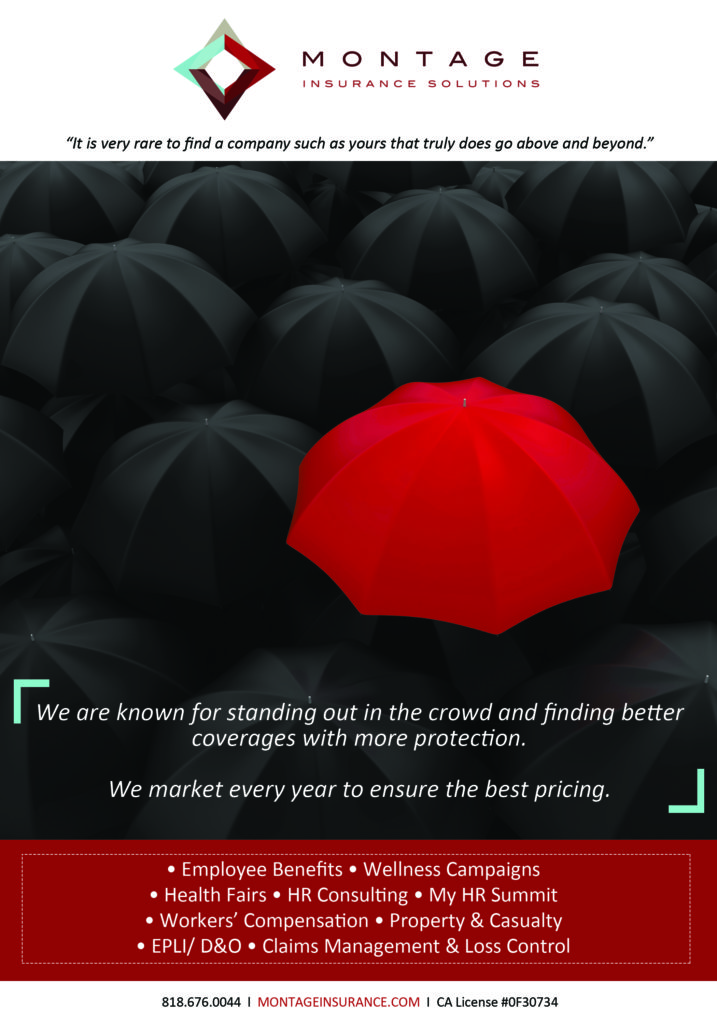

Check out Montage Insurance Solutions in the April 2014 issue of Smart Business!

Visit Simpolicy today to see how we can help individuals/families and small businesses!

Check out Montage Insurance Solutions in the April 2014 issue of Smart Business!

Visit Simpolicy today to see how we can help individuals/families and small businesses!

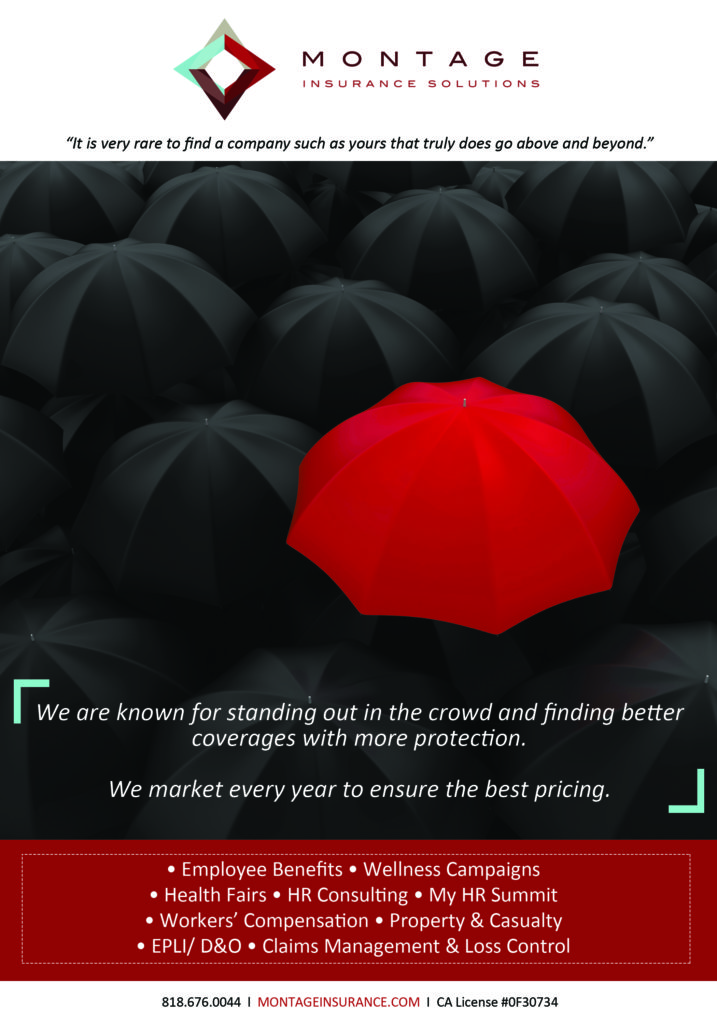

Check out Montage Insurance Solutions in the March 2014 issue of Smart Business!

Visit Simpolicy today to see how we can help individuals/families and small businesses!

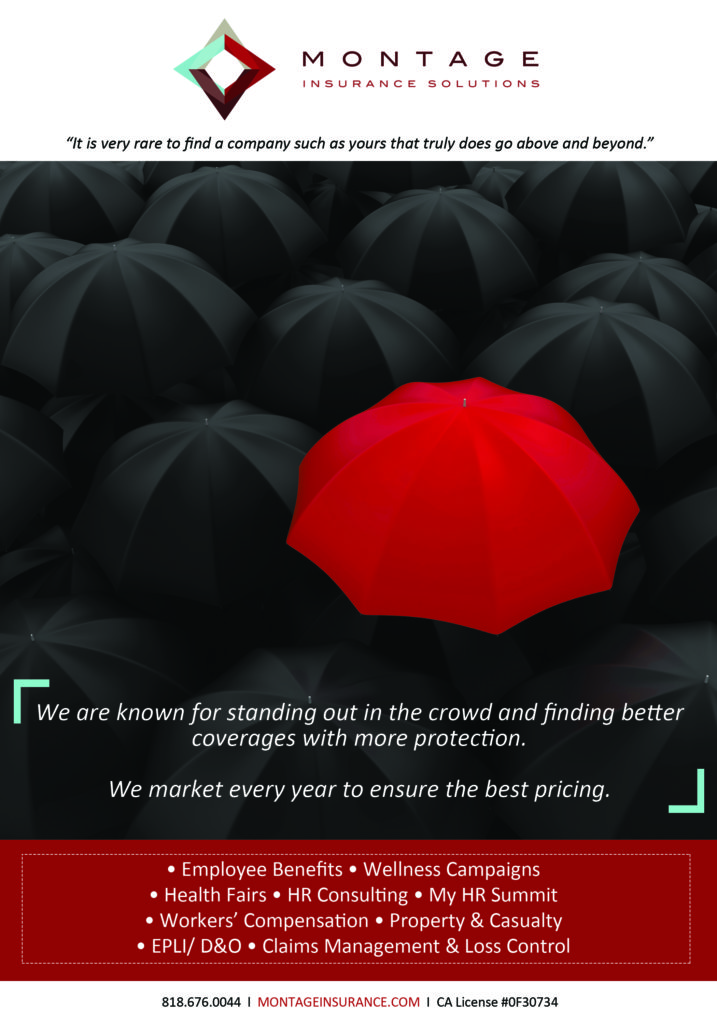

Check out Montage Insurance Solutions in the February 2014 issue of Smart Business!

Visit Simpolicy today to see how we can help individuals/families and small businesses!

Montage was ranked #18 on the SFV Business Journal’s Insurance Brokerage Firm List in the 2014 Book of Lists!

You can also check out our ad in the Los Angeles Business Journal’s 2014 Book of Lists.

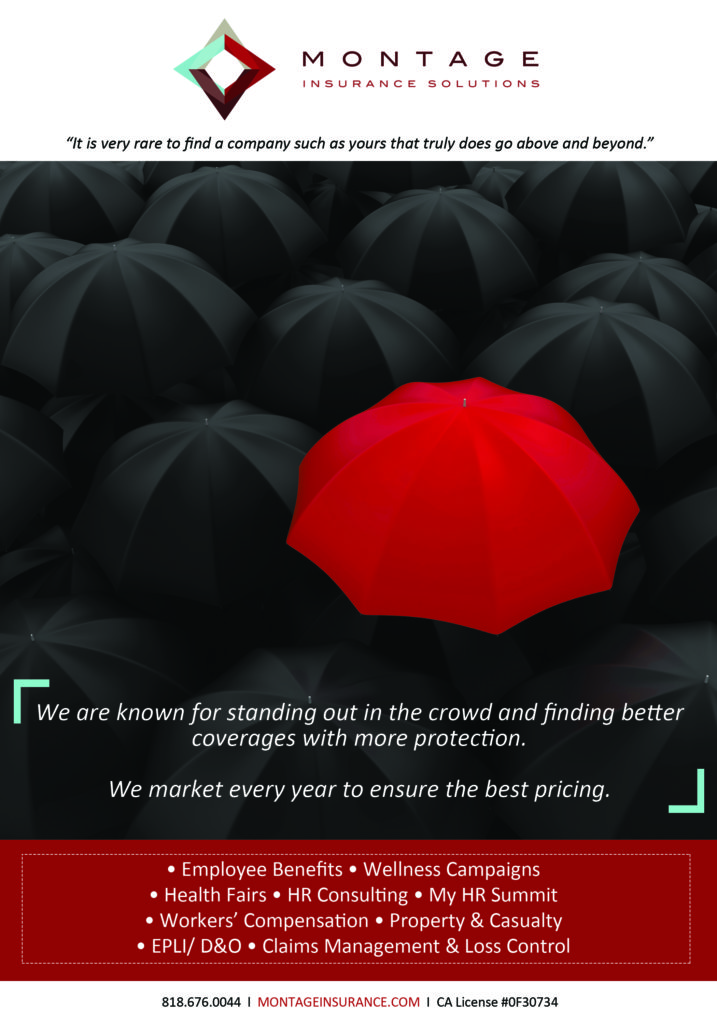

Check out Montage Insurance Solutions in the January 2014 issue of Smart Business!

Visit Simpolicy today to see how we can help individuals/families and small businesses!

Check out Montage Insurance Solutions in the December 2013 issue of Smart Business!

Visit Simpolicy today to see how we can help individuals/families and small businesses!

Check out our feature article in the November 2013 issue of Ventura Blvd!

Check out Montage Insurance Solutions in the November 2013 issue of Smart Business!

Visit Simpolicy today to see how we can help individuals/families and small businesses!

Unlocking Health Care Reform: A Look at the Individual Mandate

By Tobias Kennedy

When evaluating the Affordable Care Act (ACA), there are two angles — the employer’s angle and the individual American’s angle. Setting aside what employers need to know, in the individual world, the first thing people bring up is the individual mandate.

“It is important to discuss the individual side of the legislation, so employers know what their people face if they are not offered coverage and, also, what their part timers face who may not be eligible for the employer’s plan,” says Tobias Kennedy, executive vice president, Montage Insurance Solutions. “Employers may be considering reducing hours of certain staff down to part time, and countless American small business owners may be getting rid of coverage entirely, so a dive into the ACA’s impact on individuals is very important.”

Smart Business spoke with Kennedy about the individual mandate.

How exactly does the individual mandate work?

The individual mandate is the part of the legislation that says most U.S. citizens and legal residents must carry minimal essential coverage for themselves and their dependents. Exceptions are very rare and really only extended to incarcerated people or those who belong to a specifically recognized religiously exempt group. Other than that, pretty much all citizens and legal residents have to comply.

The good news is there are many ways for an individual to satisfy this mandate. Most commonly, people will be complying with this via employer coverage, social service programs like Medicare or Medicaid, certain Veterans Affairs programs like TRICARE or through plans purchased on the individual market including the new exchange marketplaces created by the ACA.

What happens if individuals don’t have coverage?

If a person doesn’t have coverage, there is risk of a tax penalty. The penalty begins humbly enough in 2014 at 1 percent of income, or $95 — whichever’s greater. However, in 2016, by the time it’s fully phased in, the penalty is 2.5 percent of income or $695 — again, whichever’s greater.

In fact, even though it’s called the ‘individual mandate’ people should be aware it extends beyond your self. People are not only responsible for themselves, but they’re responsible for dependents as well. If someone is on your tax return, you’re responsible for the fines if he or she doesn’t have coverage. Children’s fines are half of an adult’s, and there’s an annual cap per household, which keeps the maximum allowable penalty amount to three adults. But people will want to talk to tax professionals with an understanding that, for many folks, the individual mandate extends beyond just the individual.

How can people get help with coverage costs?

Thankfully, there is some financial help available for certain people, so it’s important to explore all of the options. This assistance comes by way of the ‘subsidies’ that have been in the news.

The subsidies are a way for people who qualify to get premium assistance, so their plan is more affordable. They are only redeemable in the exchanges and are set off of the silver plans, which are the middle of the road plans that carry a 70 percent actuarial value. Actuarial value is a broad-strokes term that describes the average a plan is designed to pay for claims expenses like deductibles and co-pays — the remainder is the average that a member is designed to pay. So, qualifying people can get a subsidy to purchase a 70 percent plan through the exchange.

The subsidy basically says ‘you are only responsible for a certain premium dollar figure per month, and we’ll cut a check to the insurance company for any overage.’ This keeps the plan’s monthly premium from going over a certain amount of out-of-pocket costs.

Qualification for the subsidy is based on a lot of factors, including having an income below 400 percent of the Federal Poverty Limit but also not having affordable coverage available elsewhere. Examples of other coverage that disqualify you for a subsidy are access to things like affordable employer coverage or social service programs like Medicare/Medicaid.

Next month, we’ll discuss all of the information surrounding how to qualify, what exactly qualification gets you, and the financial assistance’s extension beyond premiums to help with co-pays and deductibles, too. •

Tobias Kennedy is an executive vice president at Montage Insurance Solutions. Reach him at 1 (888) 839-2147 or [email protected].

Employer Checklist for ACA Action Items

By Tobias Kennedy, Executive Vice President, Montage Insurance Solutions

With so many health care reform law changes and updates, human resources professionals and companies are asking for a boiled down version of some of the main points that need to be highlighted, regarding the Affordable Care Act (ACA) and key pending action items.

Smart Business spoke with Tobias Kennedy, executive vice president, Montage Insurance Solutions, about what you need to know and do with the ACA.

What are a couple of immediate concerns for everyone?

First and foremost, make sure you got your notice out to your employees on their rights to the new marketplaces, or exchanges. Then, make sure the notice gets added to your new hire kit for future staff.

Next, employers need to look at their waiting periods and their compliance with California’s Assembly Bill 1083, which is a state law that expounds a little on the ACA. If this law applies to you, you may need to clip your waiting period if it extends beyond the allotted 60 days. Be aware this is separate than the federal bill and is set for a 2014 start date.

What extra steps do large employers need to take?

To find out if you need to comply with the employer shared responsibility provision, you have to evaluate your employees. Basically, the question is: Do you employ an average of at least 50 full-time people, including full- time equivalents. For some groups, this is an easy question. Others may waiver near the border, so it’s important to know the correct method for calculation.

If you do trigger the shared responsibility provision, you now need to be aware of exactly whom you are supposed to be offering benefits to, and exactly what types of benefits will qualify.

How should large employers keep track of their employees’ hours?

It’s a good idea for employer groups to start doing a regular check — monthly, quarterly, etc. — to see which employees are being offered coverage versus which employees are averaging more than 30 hours per week. Remember, just because you think they’re part-timers doesn’t mean they aren’t a manager’s go-to when someone calls in sick, or the workload gets hefty. It’s not uncommon for overtime hours to add up and alter a person’s average hours worked.

You’ll want to have a handle on the average hours worked by people that are not offered your benefits by running a payroll report and watching out for staff who edge up near the 30-hour average mark.

What’s key to know about insurance renewals?

You will want to note that, beginning with the upcoming January 2014 renewals, this is your last renewal to come into compliance before facing fines. Are your plan designs compliant? Is your employer/employee premium split compliant? If not, you may want to see where you are versuswhere you need to be. You’ll need to see what, if any, transitional steps you want to take this renewal, so you’re not so far off in 2015 when the potential for fines enters the picture.

Tobias Kennedy is an executive vice president at Montage Insurance Solutions. Reach him at 1 (888) 839-2147 or [email protected].